1. Introduction

2. Understanding Web3

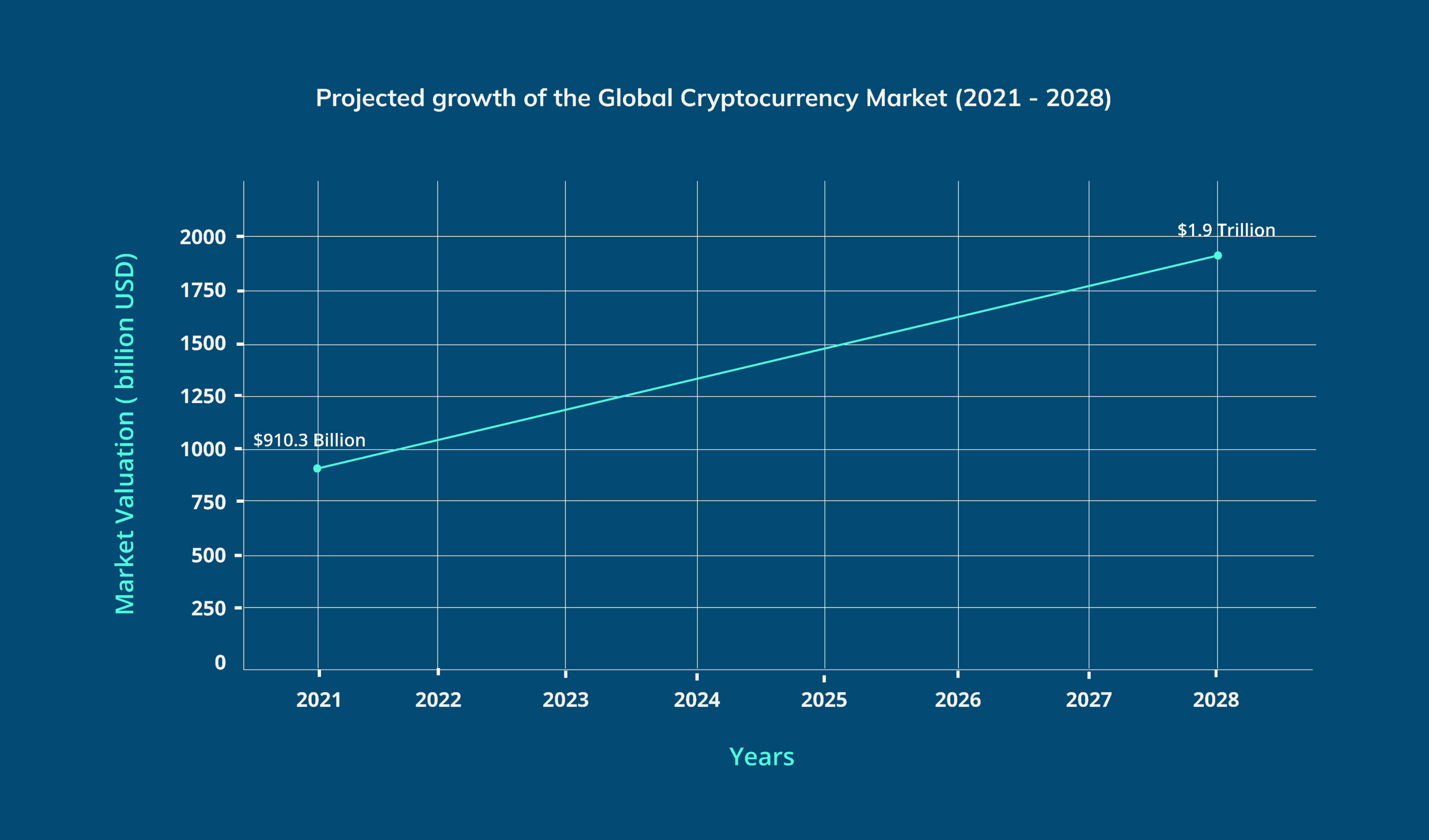

3. The Current State of Cryptocurrencies

4. A Diverse Ecosystem

-

4.1 Ethereum

Ethereum is particularly significant, as it introduced the concept of smart contracts—self-executing contracts with the terms of the agreement directly written into code. This innovation has enabled developers to build complex decentralized applications (dApps) on its platform, spanning various sectors from finance to gaming. For example, platforms like OpenSea have revolutionized the digital art market through non-fungible tokens (NFTs), allowing creators to tokenize their work and monetize it directly.

-

4.2 Solana

Solana, known for its high throughput and low transaction costs, has emerged as a strong competitor to Ethereum, attracting developers looking for scalability. Its unique consensus mechanism, Proof of History (PoH), allows for faster transaction processing, making it ideal for high-frequency applications such as decentralized exchanges (DEXs) and gaming platforms.

-

4.3 Binance Coin (BNB)

Binance Coin (BNB), initially created as a utility token for the Binance exchange, has evolved into a versatile asset used for trading fee discounts, transaction fees on Binance Smart Chain, and participating in token sales on the Binance Launchpad. Its growth illustrates how cryptocurrencies can adapt and serve multiple purposes within their ecosystems.

5. Institutional Adoption

6. The Impact of Web3 on Cryptocurrencies and Its Economic Implications

-

6.1 Increased Accessibility and Inclusivity

Web3 has the potential to revolutionize financial inclusivity by democratizing access to services traditionally controlled by centralized institutions. Cryptocurrencies, when paired with blockchain technology, empower individuals—particularly those in underserved regions—to engage with global financial systems without the barriers imposed by traditional banking infrastructure.

For instance, blockchain-enabled platforms like Celo are making significant strides in providing accessible financial services to unbanked populations, especially in regions like Sub-Saharan Africa. By leveraging mobile technology, Celo allows individuals to send, receive, and store value securely, all without needing a traditional bank account. This capability is transformative in areas where banking services are limited or non-existent, enabling users to participate in the global economy through simple mobile applications.

Moreover, the use of cryptocurrencies in remittances exemplifies this increased accessibility. Traditional remittance services often charge exorbitant fees, making it difficult for families to send money across borders. Cryptocurrencies can facilitate instantaneous, low-cost transfers, empowering families to send funds home without the burden of high fees and long wait times. This not only enhances financial inclusivity but also contributes to the economic stability of communities reliant on remittances.

-

6.2 New Business Models

The advent of decentralized finance (DeFi) and tokenization is fundamentally transforming how assets are traded and managed, giving rise to innovative business models that challenge traditional financial systems. DeFi platforms enable users to lend, borrow, and earn interest without the need for intermediaries, creating a more open and efficient financial ecosystem.

For example, platforms like Uniswap have revolutionized token trading by allowing users to swap tokens directly in decentralized marketplaces. This eliminates the need for centralized exchanges, which can be vulnerable to hacks and regulatory scrutiny. By providing liquidity pools, Uniswap empowers users to participate in trading without the risks associated with centralization. The automated nature of these platforms reduces costs and increases transaction speed, further enhancing user experience.

Tokenization is another critical development reshaping investment opportunities. By representing real-world assets—such as real estate, art, and commodities—as digital tokens on a blockchain, tokenization allows for fractional ownership. This innovation democratizes access to investments that were previously limited to wealthy individuals or institutional investors.

Platforms like Securitize facilitate this process, enabling retail investors to purchase fractions of high-value assets, thereby improving liquidity across markets. For instance, a piece of real estate can be tokenized and sold in fractions, allowing multiple investors to own shares of the property. This not only opens up new avenues for investment but also enhances market efficiency by enabling easier buying and selling of assets that were traditionally illiquid.

-

6.3 Enhanced Security and Transparency

Web3 introduces enhanced security and transparency into financial transactions. The immutable nature of blockchain technology ensures that all transactions are recorded transparently and cannot be altered retroactively. This feature is particularly important in combating fraud and building trust among users.

Decentralized identity solutions, such as those provided by projects like SelfKey, further enhance security by allowing individuals to control their personal data. Users can verify their identities without exposing sensitive information, reducing the risk of identity theft and fraud. This level of security is crucial in attracting more people to engage in the cryptocurrency ecosystem, especially those who may have been hesitant due to safety concerns.

As security and transparency become increasingly integral to the Web3 landscape, their impact on traditional financial systems becomes more pronounced, compelling institutions to adapt as well.

-

6.4 Impact on Traditional Financial Systems

The rise of Web3 and cryptocurrencies is beginning to influence traditional financial systems significantly. As DeFi platforms gain traction, banks and financial institutions are being compelled to adapt to this new landscape. Many are exploring partnerships with blockchain projects or developing their own digital currencies to remain competitive.

For instance, JP Morgan has entered the blockchain space by launching its own cryptocurrency (BBC, 2019), JPM Coin, aimed at facilitating instantaneous cross-border payments. This move highlights a growing recognition that cryptocurrencies and blockchain technology can enhance efficiency and reduce costs in traditional banking operations.

Moreover, regulatory bodies are starting to take notice. As the popularity of cryptocurrencies grows, regulators are increasingly focused on creating frameworks that ensure consumer protection while fostering innovation. This regulatory evolution is crucial for the sustainable growth of the cryptocurrency market and its integration into the broader financial system.

8. Challenges and Risks

9. Future Outlook

10. Conclusion

Collaborate with Codora