Hello! If you have any questions, concerns, or feedback, we would love to hear from you. Please don't hesitate to reach out to us via email at Hello@codora.io.

We are committed to responding to all inquiries as promptly as possible.

We look forward to connecting with you!

Hello! If you have any questions, concerns, or feedback, we would love to hear from you. Please don't hesitate to reach out to us via email at Hello@codora.io.

We are committed to responding to all inquiries as promptly as possible.

We look forward to connecting with you!

Hello! If you have any questions, concerns, or feedback, we would love to hear from you. Please don't hesitate to reach out to us via email at Hello@codora.io.

We are committed to responding to all inquiries as promptly as possible.

We look forward to connecting with you!

Hello! If you have any questions, concerns, or feedback, we would love to hear from you. Please don't hesitate to reach out to us via email at Hello@codora.io.

We are committed to responding to all inquiries as promptly as possible.

We look forward to connecting with you!

Hello! If you have any questions, concerns, or feedback, we would love to hear from you. Please don't hesitate to reach out to us via email at Hello@codora.io.

We are committed to responding to all inquiries as promptly as possible.

We look forward to connecting with you!

Hello! If you have any questions, concerns, or feedback, we would love to hear from you. Please don't hesitate to reach out to us via email at Hello@codora.io.

We are committed to responding to all inquiries as promptly as possible.

We look forward to connecting with you!

Hello! If you have any questions, concerns, or feedback, we would love to hear from you. Please don't hesitate to reach out to us via email at Hello@codora.io.

We are committed to responding to all inquiries as promptly as possible.

We look forward to connecting with you!

who we are

our mission

our strategy

We use Agile Methodology and work closely with our customers throughout the development process so that the services we provide are carefully aligned with their business objectives and go-to-market strategy. Every stage of the project goes through an extensive quality control process to ensure the best results and return on investment.

what we do

At Codora, we help businesses transform their business lifecycle into a digital ecosystem. We do that by building intelligent business solutions for our clients. Whether it’s an intuitive mobile app, an engaging website, or implementing a blockchain solution, experts at Codora will gladly take the core of the problem and present you with a sustainable and profitable solution.

EXTENDED TEAM

Reinforce your in-house team with professionals you lack with Codora’s dedicated specialists.

MANAGED TEAM

Support your operations with a fully managed team to improve your operations and meet your timelines.

DIGITAL PROJECTS

Let us take care of all your digital transformation needs. Increase your productivity and scale up.

growth with Codora’s innovative unified solution.

Here’s how you can reach us!

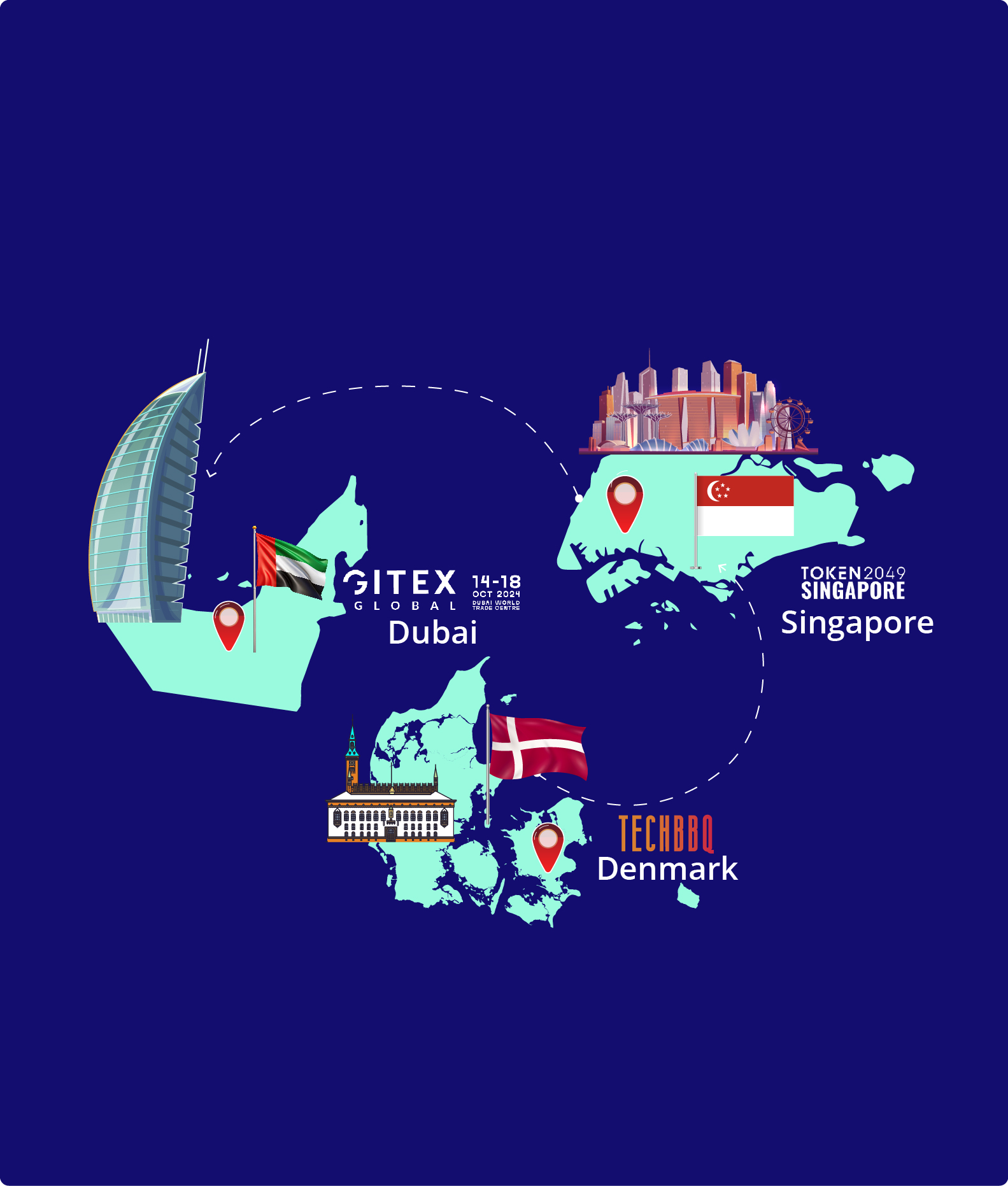

- map

- Denmark

- Canada

- UK

- Pakistan

Office 1024, 10th floor, Naverland 2, 2600 Glostrup

+45 27 14 13 33

Hello@codora.io

302-1005 King Street W,

Toronto, Ontario

+1 (647) 391-8156

Hello@codora.io

34 Holland Avenue, SW20 0RN, London

+44 20 8133 6261

Hello@codora.io

Office 1414, 14th Floor,

ISE Tower, Islamabad

+92 51 846 9048

Hello@codora.io